Good morning. Mike Shelby here, writing to you from Gray Zone Research, Forward Observer’s latest intelligence product.

With the current financial uncertainty, I wanted to take a few minutes and give you my take on what’s happening with the banking industry, the financial crisis, the recession, and where I believe we’re headed.

Pay close attention to the last section…

Bottom Line Up Front:

- This financial crisis will end the short-term boom-bust cycle and, more importantly, end the long-term boom-bust cycle with catastrophic consequences. This is the event you should be preparing for.

Here’s why I think this.

First, right now banks can park their cash at the Federal Reserve risk-free at nearly a 5% yield, which reduces the incentive for them to approve loans heading into a period of financial uncertainty.

The net result is that we’re likely to see credit rationing as banks improve their reserve ratios by pulling back on loans.

Second, this is accelerating the end of the short-term boom-bust cycle as credit availability dries up and commercial banks are less willing to provide loans.

Credit and loan deterioration are early warning indicators of a recession.

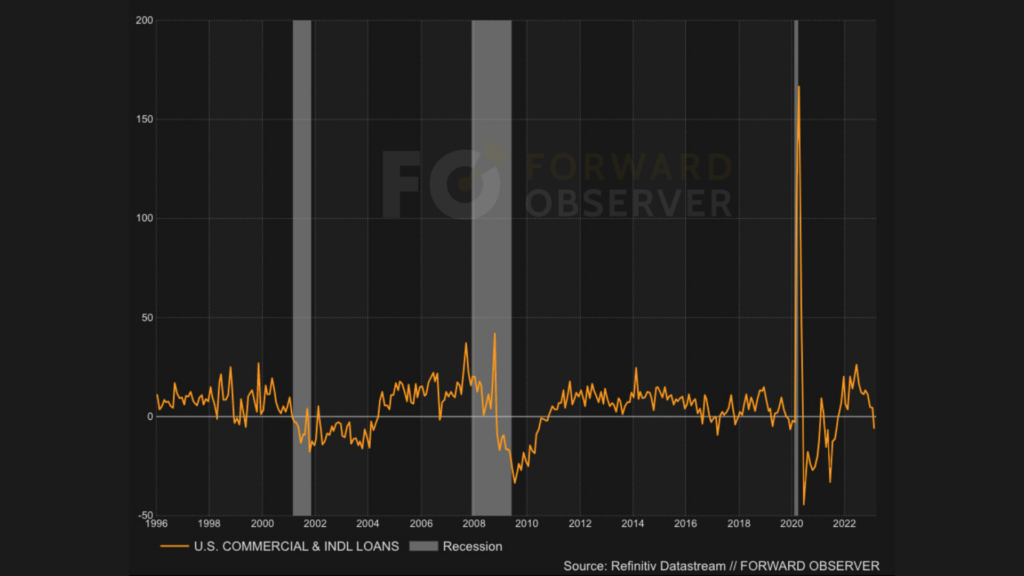

As of February, U.S. commercial and industrial loans are in contraction territory at -5.9. (See chart below.)

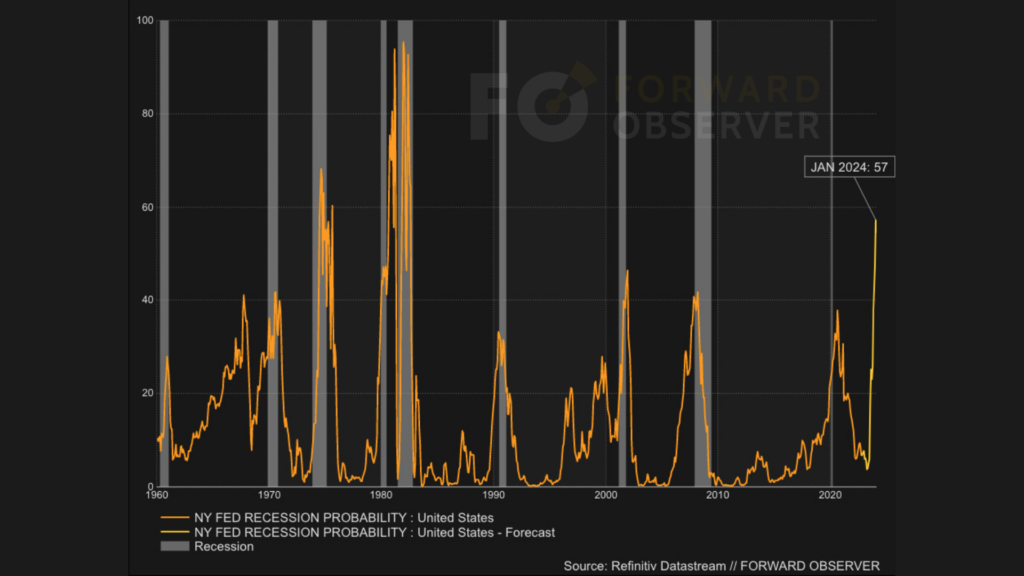

Next is the New York Fed’s Recession Probability, which rises from 5.5% this month to 57% in January 2024. That’s the highest since the 1980s and higher than 2001 and 2008. Readings over 40% are 6-for-7, so it’s a fairly reliable indicator.

Third, the developing financial crisis, which I believe has already started in the tech sector, will lead to recession.

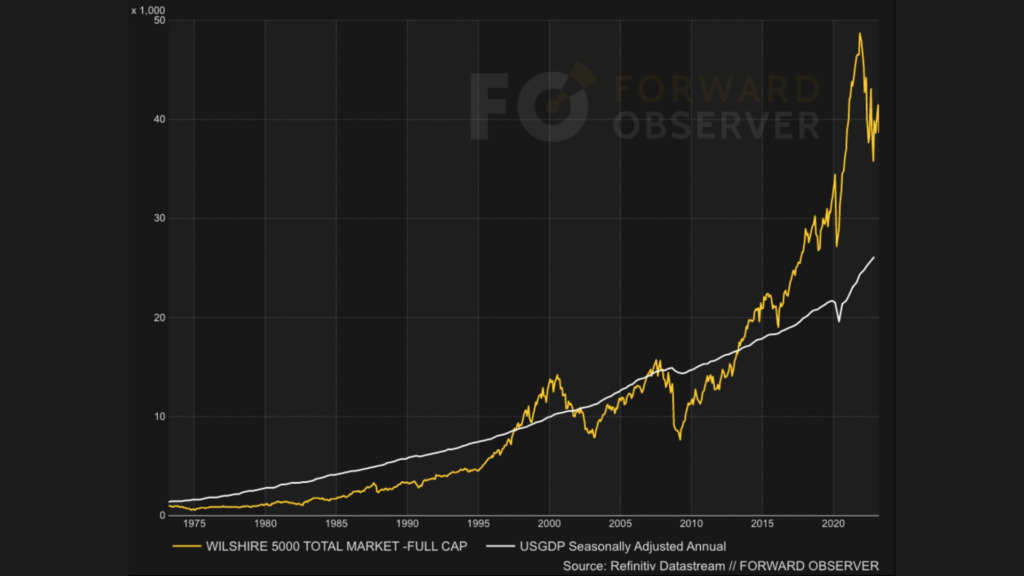

Just like cheap money flowed into housing before the last financial crisis, easy money has flowed into startups and tech, which led to outlandish, inflated valuations – a bubble which is now bursting.

And it’s not confined just to tech, either. Here’s a check in on the Buffet Indicator, which shows that even after last year’s correction, U.S. markets remain overvalued against future conditions. What’s to come has not been “priced in”.

(By the way, I first shared this with subscribers in early 2022. Check out the market bubble last year compared to the 2001 and 2008 bubbles.)

The results are three-fold:

- First, defaults and bankruptcies will almost certainly rise this year as credit availability deteriorates and zombie companies are denied successive loans, default on their debt, and are forced into bankruptcy.

- Two, once awash with cash, these startups and tech companies are being squeezed, drawing down cash deposits, and exposing banks that have liquidity problems. This is exactly what happened to Silicon Valley Bank, where the inability to service withdrawals led to collapse.

- Three, mid-sized regional banks that have the greatest exposure to tech and zombie companies have the greatest risk. As regional banks are threatened by decreased deposits and loan losses, and as profits dry up due to a slowdown in lending and credit rationing, there’s an increased risk of failures and/or absorption into larger banks. Under these conditions, bank consolidation is likely to be a major trend over the next several years. On Wednesday, I noted to SA subscribers that BlackRock’s Larry Fink is concerned about slow, protracted financial turmoil, similar to the 1986-1995 Savings and Loan Crisis where nearly a third of savings and loan institutions failed (over 1,000 in total). This is a likely scenario, but the worst is still yet to come.

This is the End of the Long-Term Boom-Bust Cycle

(This is the Most Important Section to Read…)

This financial crisis will end the current short-term boom-bust cycle, as I mentioned above.

But it’s also likely the beginning of the end of the long-term boom-bust cycle where economic, financial, and monetary conditions start to break down.

On a macro level, I’ll refer to two of Ray Dalio’s books: Big Debt Crises and The Changing World Order.

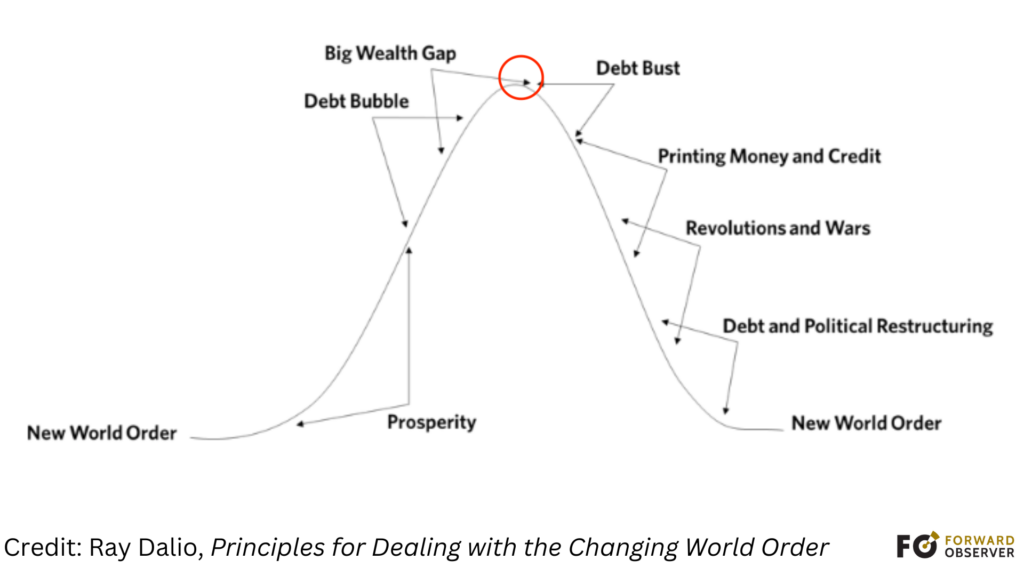

Dalio, a former hedge fund manager, provides this chart (below) that describes how a new world order emerges as the old one collapses (the historical cycle).

He says this will coincide with the end of the current long-term debt cycle in the United States.

I’ve circled where I think we are in this cycle. (Note: we haven’t reached peak money printing yet, but that’s coming.)

If Ray Dalio is correct, then this is the beginning of the end for the American Empire.

If you want to go deeper into the “fringe” topic of what happens at the end of empire and how to prepare for it, it’s the main focus of Gray Zone Research, a new research and intelligence report launching in April.

Whether you’re a business leader, investor, or concerned citizen, our reporting on the end of the American empire and what follows is a must-read for anyone looking to navigate this Gray Zone future.

You can learn more and join us here.

Until next time, be well and stay out front.

Always Out Front,

Mike Shelby

P.S. – There’s an incredible limited time offer for current Forward Observer subscribers now through Monday.

1 Comment